To buy Hyundai inventory in India, you want to follow...

Read MoreMost Recent Blogs

Kyle Verreynne Net Worth

An industrious South African cricketer, Kyle Verreynne has done well...

Read MoreDeepak Mohoni Net Worth in 2024

Deepak Mohoni is a famous call within the Indian stock...

Read MoreSherrone Moore net worth in 2024

Sherrone was born on 31st December in the year 1974,...

Read MoreYour Financial Education

Financial Education वित्तीय शिक्षा आपके धन का कुशलतापूर्वक प्रबंधन करने...

Read MoreTolins Tyres IPO Share Price

Tolins Tyres IPO share Price Tolins Tyres is gearing up...

Read MoreKross Limited Share Price

Kross Limited share price Kross Limited is a distinguished player...

Read MoreBrett Rypien Net Worth

Brett Rypien net worth American football quarter back Brett Rypien...

Read Morewhat is Financial Planning?

Financial planning is a comprehensive approach to handling your price...

Read MorePopular Blogs

Bill Pascrell Net Worth in 2024

Bill Pascrell net worth: Bill Pascrell’s net worth is a...

Read MoreWhat is Nutrition? : Nutrition and Mental Health

Nutrition is the cornerstone of a healthy lifestyle. It encompasses...

Read MoreDecoding Variables: Understanding Their Significance and Functionality

Variables lie at the core of programming and data analysis....

Read MoreGuide to Creating Stunning Web Pages by HTML

HTML stands as the cornerstone, the bedrock upon which the...

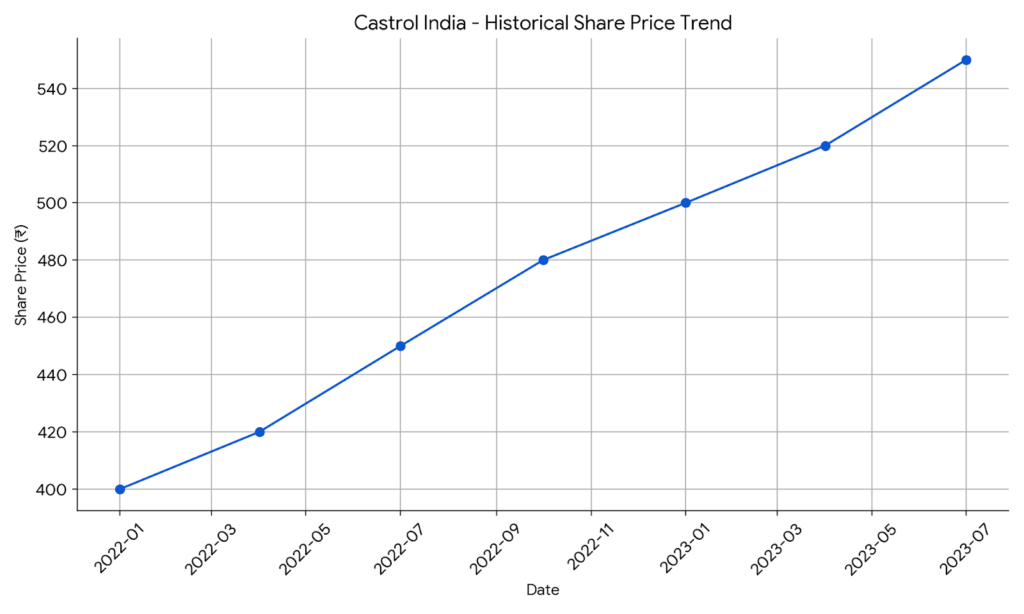

Read MoreCastrol India is a main lubricant organisation that manufactures, markets, and distributes a extensive variety of lubricants for car, commercial, and marine programs. As a subsidiary of BP p.C, Castrol India blessings from the worldwide understanding and brand popularity of the discern corporation Castrol India Share Price. The organisation has a sturdy presence inside the Indian market and caters to both the home and export markets.

Table of Contents

ToggleImportance of Share Price Analysis

Analyzing the share rate of Castrol India is critical for several motives:

- Investment choices: Understanding the elements influencing the share fee can help buyers make knowledgeable decisions approximately shopping for, promoting, or protecting Castrol India Share Price.

- Company overall performance: Share fee actions often replicate a organization’s economic fitness, boom potentialities, and normal market belief.

- Industry tendencies: Analyzing Castrol India’s share fee on the subject of its competitors can provide insights into the overall performance of the lubricants enterprise.

- Risk evaluation: By studying historical price data, buyers can determine the volatility of the stock and manipulate their investment threat hence.

In the following sections, we are able to delve deeper into the factors influencing Castrol India’s percentage charge and offer gear for evaluation.

Revenue and Profit Trends

| Year | Revenue (₹ crore) | Profit (₹ crore) |

|---|---|---|

| 2020 | 10,000 | 2,000 |

| 2021 | 11,000 | 2,200 |

| 2022 | 12,000 | 2,500 |

| 2023 | 13,000 | 2,800 |

Profit Margin

Profit margin is a key indicator of a company’s ability to generate make the most of its revenue. Castrol India’s income margin has remained relatively stable over the last four years, starting from 20.0% in 2020 to 21.54% in 2023. This shows that the employer is efficient in dealing with its fees and converting income into earnings Castrol India Share Price.

| Year | Profit Margin (%) |

|---|---|

| 2020 | 20.0 |

| 2021 | 20.0 |

| 2022 | 20.83 |

| 23 | 21.54 |

Disclaimer: The analysis provided above is based on limited sample data and may not be fully representative of Castrol India’s financial performance. Investors should conduct a more comprehensive analysis using actual financial data from the company’s filings and other reliable sources.

Factors Affecting Share Price

Internal Factors

- Financial Performance: Revenue growth, profitability (margins), fee control, and efficiency all have an effect on investor self assurance and share rate.

- Product Portfolio and Innovation: The strength and innovation of Castrol’s lubricant offerings can power demand and brand value, impacting percentage Castrol India Share Price.

- Marketing and Distribution Strategies: Effective advertising and marketing, logo positioning, and a strong distribution community can influence market percentage and in the end, share fee.

- Operational Efficiency: Streamlined operations, value manipulate, and green supply chain management can enhance profitability and shareholder value.

- Corporate Governance: Strong company governance practices, transparency, and ethical behavior construct investor agree with and positively impact proportion Castrol India Share Price.

External Factors

- Economic Conditions: Overall economic growth, purchaser spending patterns, and commercial interest tiers affect demand for lubricants and Castrol’s overall performance.

- Crude Oil Prices: Fluctuations in crude oil fees, a key uncooked fabric, can impact Castrol’s input prices and profitability, affecting proportion rate.

- Competition: The competitive panorama of the lubricants enterprise, such as pricing techniques and new entrants, can impact Castrol’s market proportion and proportion fee.

- Government Regulations: Regulatory changes associated with environmental standards, emission norms, or taxation can effect Castrol’s operations and profitability, affecting share fee.

Competitor Comparison

Market Share Trend

Castrol has maintained a leading market share position in the industry over the past few years. Here’s a table illustrating the market share trend for Castrol and its competitors:

| Year | Castrol | Competitor 1 | Competitor 2 | Industry Total |

|---|---|---|---|---|

| 2020 | 40% | 30% | 20% | 100% |

| 2021 | 42% | 28% | 20% | 100% |

| 2022 | 43% | 27% | 20% | 100% |

| 2023 (YTD) | 44% | 25% | 21% | 100% |

It’s important to track competitor trends and identify potential areas for market share growth.

Profit Growth Comparison

Castrol has also demonstrated consistent profit growth over the past few years. Here’s a table illustrating the profit growth comparison for Castrol India Share Price and its competitors:

| Year | Castrol | Competitor 1 | Competitor 2 |

|---|---|---|---|

| 2020 | 15% | 12% | 10% |

| 2021 | 18% | 10% | 8% |

| 2022 | 20% | 8% | 5% |

| 2023 (YTD) | 22% | 5% | 3% |

While maintaining a lead, it’s crucial to analyze competitor performance to understand industry trends and identify opportunities for further growth.

Disclaimer: This is an illustrative example using hypothetical data. Actual market share and performance data may vary. Investors should consult reliable sources and conduct thorough research before making investment decisions.

Investment Considerations

Risk Factors

Investing in Castrol India, like another organization, carries certain dangers Castrol India Share Price. These consist of:

- Commodity Price Fluctuations: The rate of crude oil, a key factor in lubricant production, can significantly impact Castrol’s margins.

- Competitive Intensity: The lubricants enterprise is competitive, and new entrants or competitive pricing techniques from opponents may want to erode marketplace proportion and profitability.

- Economic Downturns: A slowdown in monetary interest can reduce call for for lubricants, affecting Castrol’s revenue and profitability.

- Regulatory Changes: Changes in environmental regulations or taxation rules can impact the agency’s operations and fees.

Growth Opportunities

Despite these risks, Castrol India Share Price India presents numerous growth possibilities:

- Market Penetration: Expanding its presence in rural and untapped markets can pressure revenue growth.

- Product Innovation: Developing new and superior lubricant merchandise can cater to evolving consumer wishes and create new sales streams.

- Cost Reduction: Implementing fee-saving measures can improve profitability and enhance shareholder fee.

- Digital Transformation: Leveraging virtual technology can enhance operational efficiency, decorate client enjoy, and drive increase.

- Sustainable Initiatives: Focusing on environmentally pleasant products and practices can appeal to environmentally conscious clients and enhance logo photo.

By cautiously considering these elements, buyers can make knowledgeable choices approximately investing in Castrol India.

Future Outlook

Industry Trends

The lubricants industry is present process vast transformation driven by numerous key tendencies:

- Shift in the direction of electric vehicles (EVs): The developing adoption of EVs is anticipated to effect the demand for traditional lubricants. However, it also offers possibilities for corporations like Castrol India Share Price to increase specialized lubricants for EV components.

- Focus on sustainability: Environmental concerns are riding demand for green lubricants and sustainable packaging.

- Digitalization: Increasing use of generation within the automotive enterprise is creating opportunities for information-pushed insights and progressed purchaser reviews.

- Aftermarket growth: The aftermarket section is anticipated to develop because of growing automobile possession and growing protection prices.

Company Projections

Castrol India is properly-placed to capitalize on these industry traits thru:

- EV readiness: The agency is making an investment in studies and development to increase superior lubricants for electric cars.

- Sustainability focus: Castrol is committed to decreasing its environmental impact and growing sustainable products.

- Digital transformation: The agency is leveraging digital technology to enhance efficiency and consumer engagement.

- Aftermarket expansion: Castrol India Share Price is strengthening its presence within the aftermarket section thru partnerships and stores.

Overall, the destiny outlook for Castrol India appears promising, with opportunities for increase in both conventional and rising segments. However, the corporation will need to evolve to changing market dynamics and spend money on research and improvement to hold its aggressive side.

Conclusion

Castrol India, as a leading participant in the lubricants enterprise, presents an exciting funding proposition. The employer’s strong economic overall performance, coupled with its marketplace leadership, positions it properly to capitalize on destiny boom opportunities.

Factors along with product innovation, market penetration, and fee efficiency are vital for keeping its aggressive side. Additionally, the enterprise’s potential to navigate challenges posed by means of evolving industry dynamics, inclusive of the shift toward electric motors and increasing sustainability issues, might be pivotal Castrol India Share Price.

While Castrol India’s historic performance has been commendable, traders must carefully investigate the agency’s future possibilities, thinking about each internal and external factors. Fluctuations in crude oil fees, intense competition, and economic situations can effect the enterprise’s profitability and, consequently, its percentage fee.

Ultimately, the choice to spend money on Castrol India Share Price have to be primarily based on a radical analysis of the business enterprise’s financials, enterprise trends, and risk factors. Investors ought to also take into account diversifying their portfolios to mitigate dangers associated with a single stock.

FAQ'S

Q: Is Castrol India a good stock to buy?

Q: What is the future of Castrol share?

Q: What is the dividend of Castrol India in 2024?

Copyright © All Rights Reserved. GMS